Hey everyone, the cryptocurrency market offers great opportunities for financial freedom, but it comes with huge risks.

Interestingly, you can make money with cryptocurrencies through staking, lending, trading, and holding investments. But today we will focus on making money by trading cryptocurrency futures.

So what is cryptocurrency futures trading?

On some crypto trading platforms, the futures market is also called the derivatives market. This means you can use the platform’s borrowed funds to increase your trading position, allowing you to control a larger position compared to trading with your capital.

For example, if you have $1,000, you can use 10x leverage to control a position size of $10,000. We shall discuss this strategy in later parts of this article.

When trading assets like Bitcoin in the futures market, you can use leverage ranging from 1 to 125x, depending on your trading platform. However, you must learn about risk management to remain disciplined in the market.

Just because your trading platform offers 100% or 125% leverage does not mean you should use it. Because, as a novice trader, using high leverage is the easiest way to lose money in the cryptocurrency futures market.

Therefore, always manage your risk by using low leverage, such as 5%-10%, to protect your capital even if the market moves against you a few times.

Differences Between Isolated and Cross Margin

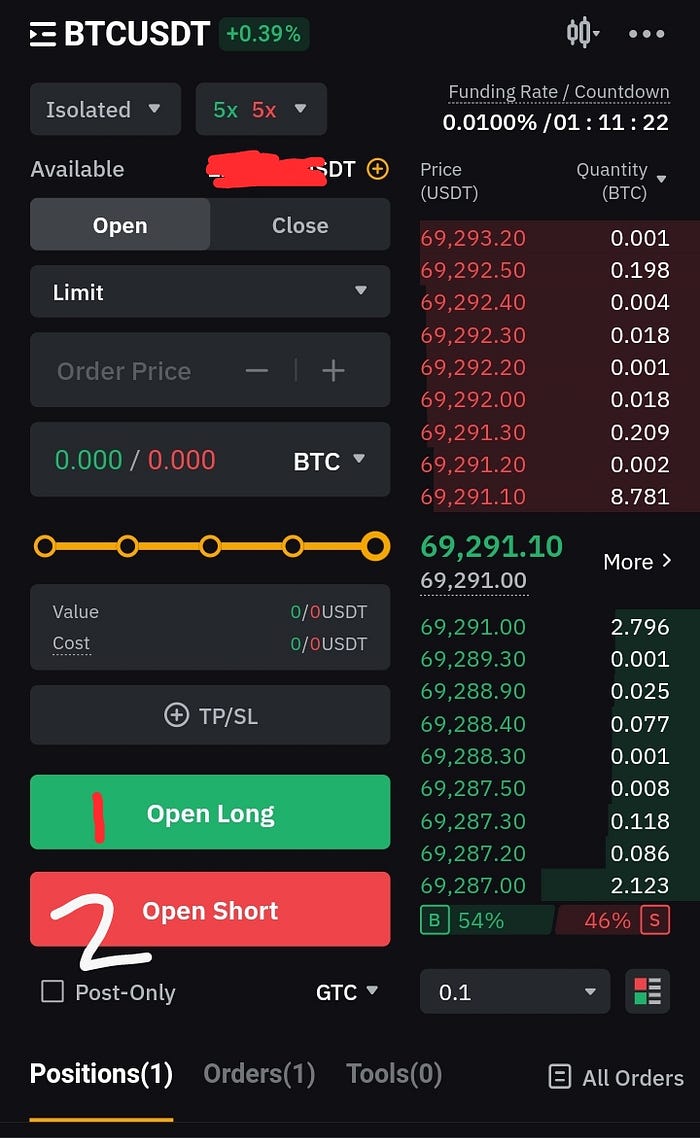

When trading cryptocurrency with leverage, your trading platform will require you to choose between isolated and cross-margin options.

Isolated margin allows you to specify the amount of assets you are willing to risk per trade, while cross-margin means you are willing to risk your full asset (equity) per trade.

I often use the “Isolated” margin when trading the futures market, but you can experiment to find what works best for you.

You also need to select “Limit”, “Order Price”, and “Quantity (Qty)”, and then click “Open Long” to buy the asset or “Open Short” to sell the asset. Lastly, you can set your stop-loss and take profit target if you didn’t do that while opening your position. See the screenshot below.

Before opening a trading position, you should have done your technical analysis to predict the next price movement of the pair you are interested in.

I focus only on Bitcoin when trading the futures or derivatives market, as it mainly determines the movement of other pairs and is less volatile compared to low-cap altcoins.

For technical analysis, you would need an account with Tradingview.com or GoCharting.com. Interestingly, I prefer GoCharting.com because it offers more utilities to free users. See the screenshot below.

Technical Analysis:

When analyzing the cryptocurrency market, simply use effective tools and indicators. Fortunately, you can access top-tier tools and indicators for free on GoCharting.com.

I typically rely on EMAs, MACD, and RSI for chart analysis. To learn more about free indicators for traders, read the article below.

Best 7 Free Trading Indicators for Every Cryptocurrency Trader

Here are my top 7 technical trading indicators for analyzing the cryptocurrency market.

How to Use Leverage in Crypto

Now that we’ve covered the basics, let’s explore how to use leverage to increase our position size.

For example, when trading Bitcoin in the futures market, you can open a Long (Buy) position if you anticipate the price to increase based on your analysis. By using a 5–10% leverage, you can increase your position size and potentially earn more if the trade goes in your favor.

On the other hand, you can open a Short (Sell) position if you expect the price to decrease. However, you must have a solid understanding of technical analysis to fully capitalize on the market and trade in the direction of price movement to maximize profits. You can download the Trader’s Manual Handbook to master technical analysis skills.

Order form

Download Your Copy!

How to Calculate Profits and Losses

When analyzing a trading pair such as BTC-USD, it is important to calculate your risk-to-reward ratio before placing a trade. Let’s consider the example below:

Example 1: Profit Scenario

If you deposit $500 into your trading account and use a 10x leverage, your trading platform will offer you a position size of $5,000. This means that if the market moves 10% in your favor, you can easily win $500.

So, if you close the trade at this point, you will have $1,000. And if you use higher leverage, you could earn higher returns. But it comes with a higher risk.

Example 2: Loss Scenario

Let’s say you start trading with $500 and use 10x leverage without setting a stop-loss target. If the market moves 10% against you, you could lose your entire trading capital ($500).

This is why it is important to set a stop loss target and a take profit target when entering a trade to protect your capital from liquidation.

Setting Risk-to Reward Ratio

When trading Bitcoin, I typically use a risk-to-reward ratio of 1:5 or 1:10, depending on market conditions and volatility. This means you are willing to risk 1% of your trading capital to earn a 5–10% return.

So even if you lose 3 trades and win 1 trade, you can still make a profit using this strategy. So, always set stop-loss and take-profit targets to get protection in the market.

Final thoughts

Before trading cryptocurrencies with leverage, it is important to learn about risk management, develop a trading strategy, keep learning until you have a good strategy, and never trade without stop-loss and take-profit targets.